Financials

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS FOR THE SECOND QUARTER AND SIX MONTHS ENDED 30 JUNE 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

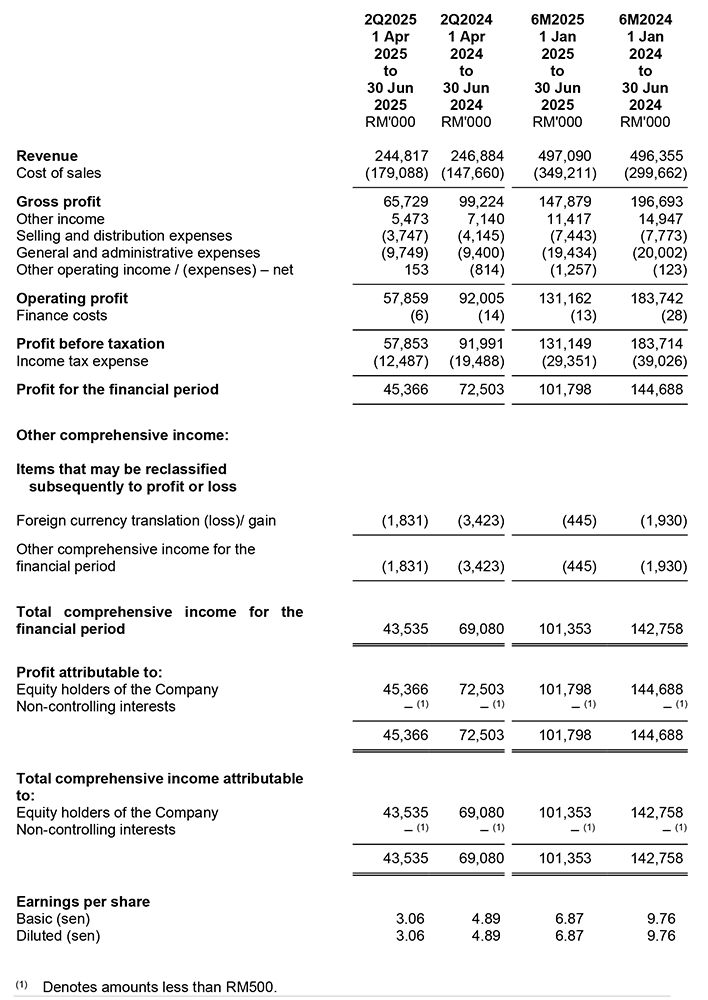

Condensed interim consolidated statement of profit or loss and other comprehensive income

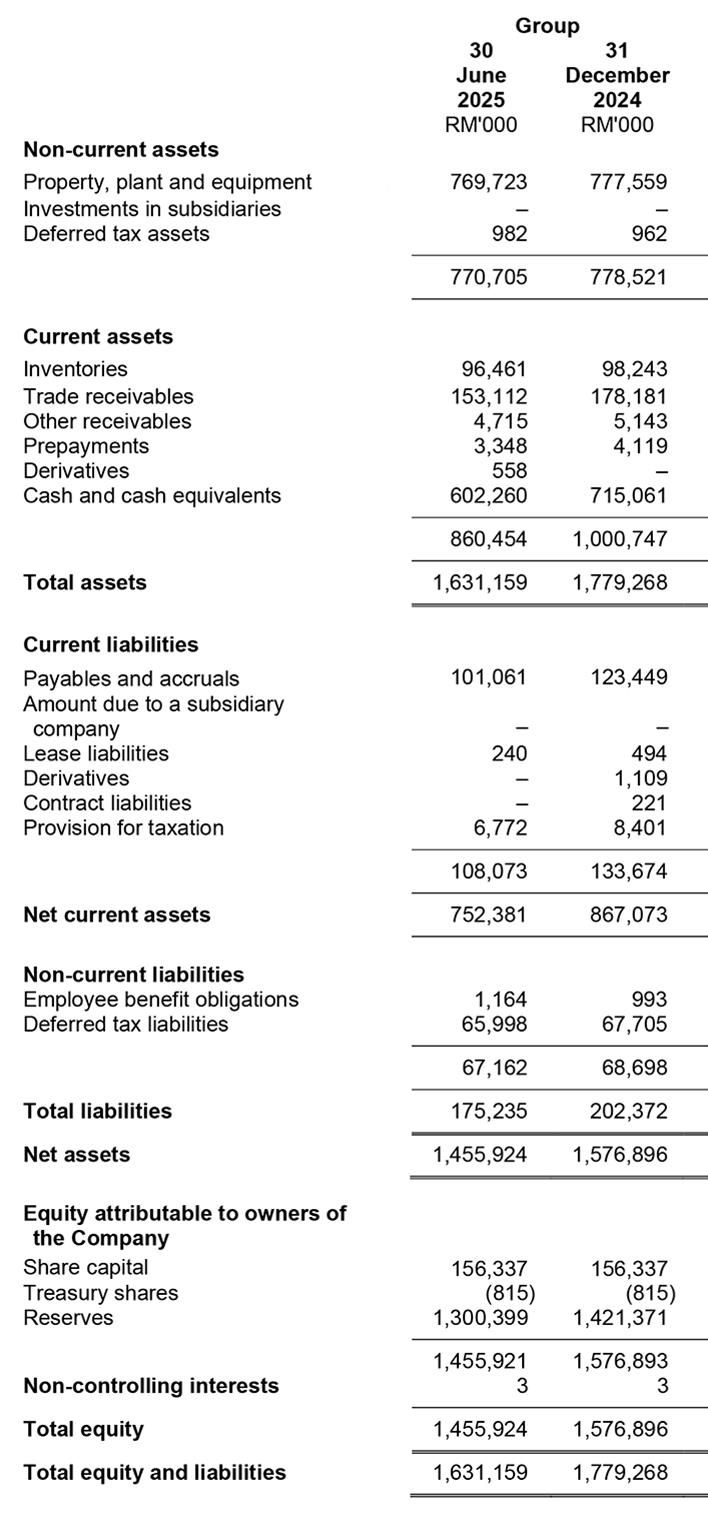

Condensed interim statements of financial position

Review Of Performance

Income Statement Review

For 2Q2025, the Group achieved RM244.8 million in total revenue, a 0.8% decrease as compared to RM246.9 million in 2Q2024. Cost of sales increased to RM179.1 million in 2Q2025, a 21.3% increase from RM147.7 million in 2Q2024. The Group's gross profit dropped by 33.8% from RM99.2 million in 2Q2024 to RM65.7 million in 2Q2025. Group's gross profit margin dropped from 40.2% to 26.8% due to higher cost of sales for the quarter.

The Group's other income reduced by 23.3% to RM5.5 million in 2Q2025. These are mainly due to lower interest rates from balance of fixed deposits.

Selling and distribution expenses declined by 9.6% in 2Q2025, primarily attributable to a reduction in sales-related activities and associated expenditures.

General and administrative expenses rose by 3.7% to RM9.7 million in 2Q2025, primarily driven by higher staff-related costs.

Other operating income was at RM0.2 million in 2Q2025 as compared to other operating expenses of RM0.8 million in 2Q2024. The turnaround from other operating expenses to income was mainly due to a substantial gain on disposal of property, plant and equipment (PPE).

The Group's effective tax rate was higher at 21.6% in 2Q2025 compared to 21.2% in 2Q2024 due to lower reinvestment allowances recognised in 2Q2025. In 2Q2025, income tax expense decreased by 35.9% to RM12.5 million as a result of lower taxable income.

Overall, in 2Q2025, the Group's profit before tax and profit after tax reduced by 37.1% and 37.4% respectively.

Balance Sheet Review

As at 30 June 2025, non-current assets which consist of PPE and deferred tax assets (DTA), decreased to RM770.7 million from RM778.5 million. PPE decreased to RM769.7 million from RM777.6 million mainly due to depreciation charge of RM36.2 million. DTA remained flat at RM1.0 million.

As of 30 June 2025, inventories declined to RM96.5 million from RM98.2 million compared to 31 December 2024, primarily due to increase in sales volume. Trade receivables decreased from RM178.2 million to RM153.1 million mainly due to improvement in collections.

Cash and cash equivalents decreased to RM602.3 million as at 30 June 2025 from RM715.1 million as at 31 December 2024. For the 2Q2025, the Group generated RM94.6 million of net cash flows from operating activities and net cash flows used in investing activities amounting to RM13.6 million were mainly for the purchase of PPE. The Group has net cash flows used in financing activities in 2Q2025 amounting to RM222.4 million for the payment of dividends and repayment of lease liabilities.

Current liabilities reduced to RM108.1 million as at 30 June 2025 mainly due to lower payables and accruals. Payables and accruals decreased to RM101.1 million as at 30 June 2025 from RM123.4 million as at 31 December 2024.

Non-current liabilities decreased to RM67.2 million as at 30 June 2025 from RM68.7 million mainly due to lower deferred tax liabilities.

Commentary On Current Year Prospects

The business is currently navigating a challenging environment of price competition, currency fluctuations, volatile raw material prices, and increased production costs. We are closely monitoring the situation particularly on the potential impact of US tariffs and actively exploring strategies to mitigate risks.