This printed article is located at http://riverstone.listedcompany.com/financials.ihtml

Financials

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS FOR THE SECOND QUARTER AND SIX MONTHS ENDED 30 JUNE 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

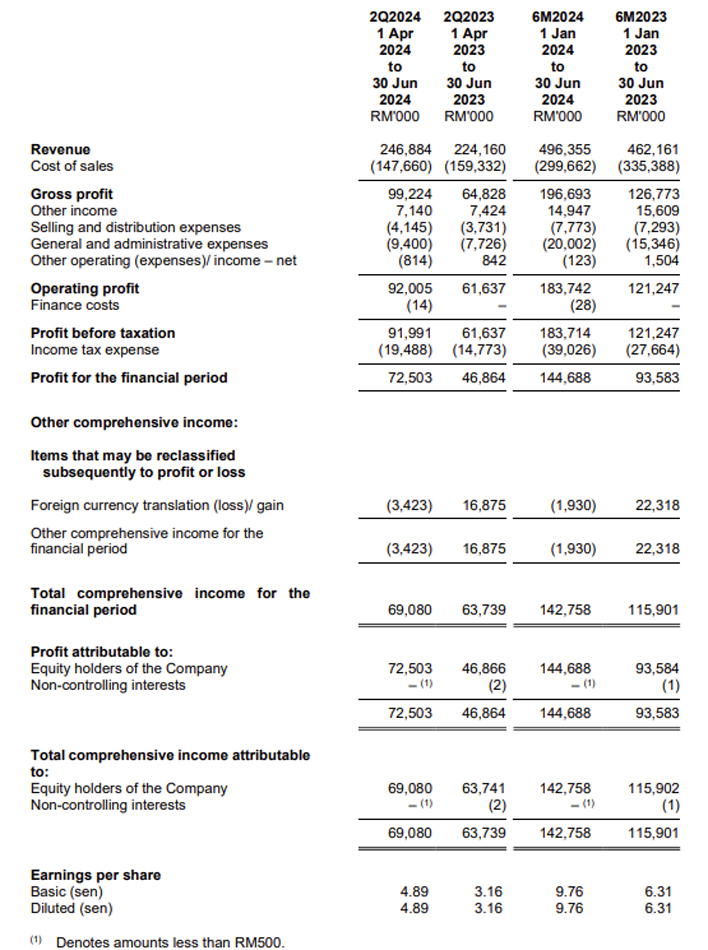

Condensed interim consolidated statement of profit or loss and other comprehensive income

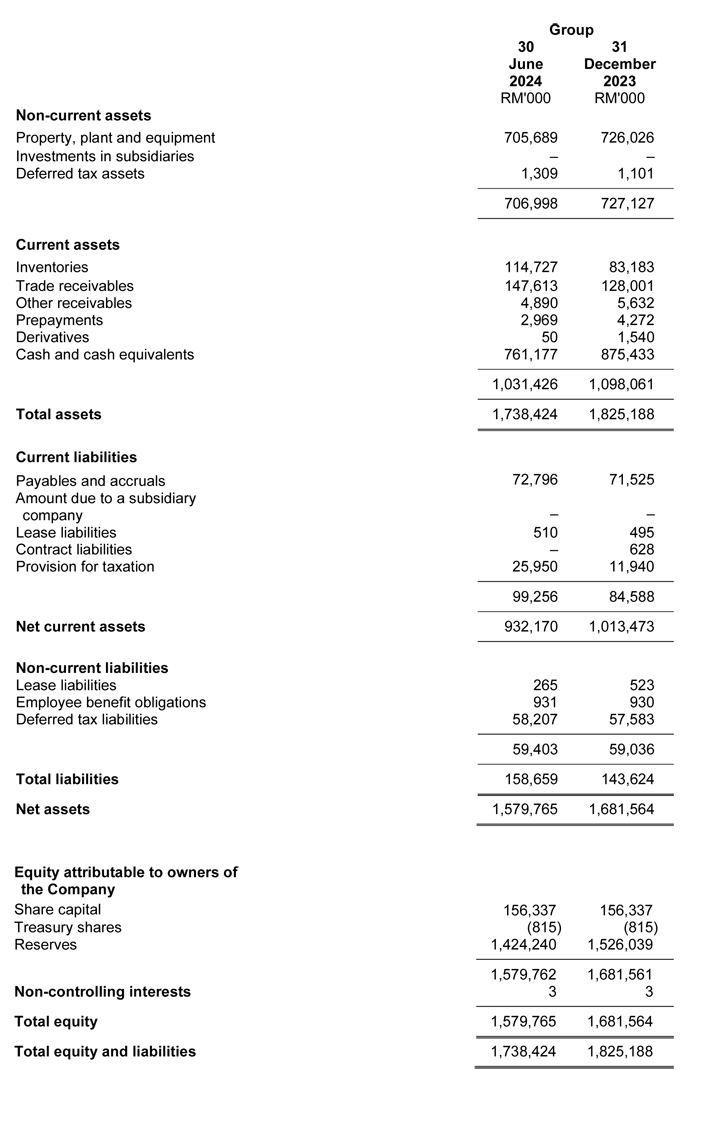

Condensed interim statements of financial position

Review Of Performance

Income Statement Review

For 2Q2024, the Group achieved RM246.9 million in total revenue, a 10.1% increase as compared to RM224.2 million in 2Q2023. Cost of sales however reduced to RM147.7 million in 2Q2024, a 7.3% reduction. The Group's gross profit up 53.1% from RM64.8 million in 2Q2023 to RM99.2 million in 2Q2024. Group's gross profit margin improved from 28.9% to 40.2% due to higher average selling price for the quarter and lower cost of sales.

The Group's other income reduced by 3.8% to RM7.1 million in 2Q2024. These are mainly due to interest income from lower balance of fixed deposits.

Selling and distribution expenses increased by 11.1% in 2Q2024 mainly due to increasing sales activities.

General and administrative expenses increased by 21.7% to RM9.4 million in 2Q2024 mainly due to increase in performance incentives.

In 2Q2024, other operating expenses closed at RM0.8 million, a 196.7% decrease as compared to 2Q2023 mainly due to lower net foreign exchange gain.

The Group’s effective tax rate was lower at 21.2% in 1H2024 compared to 22.8% in 1H2023 due to higher reinvestment allowances recognised in 1H2024. In 2Q2024, income tax expense increased to RM19.5 million as a result of higher taxable income.

Overall in 2Q2024, the Group's profit before taxation and profit after taxation increased by 49.2% to RM92.0 million and 54.7%. to RM72.5 million respectively.

Balance Sheet Review

As at 30 June 2024, non-current assets which consist of property, plant and equipment (PPE) and deferred tax assets, decreased to RM707.0 million from RM727.1 million. PPE decreased to RM705.7 million from RM726.0 million mainly on additions amounting to RM11.8 million coupled with foreign exchange adjustment offset by the depreciation charge of RM31.8 million and PPE written off or disposed. Deferred tax assets (DTA) has increased to RM1.3 million.

As of 30 June 2024, inventories rose to RM114.7 million from RM83.2 million compared to 31 December 2023, primarily due to increase in production volume. Similarly, trade receivables increased from RM128.0 million to RM147.6 million mainly due to normalisation of credit terms.

Cash and cash equivalents reduced to RM761.2 million as at 30 June 2024 from RM875.4 million as at 31 December 2023. For the 2Q2024, the Group generated RM93.1 million of net cash flows from operating activities and net cash flows used in investing activities amounting to RM9.8 million were mainly for the purchase of PPE. The Group has net cash flows used in financing activities in 2Q2024 is mainly for payment of dividends.

Current liabilities increased to RM99.3 million as at 30 June 2024 mainly due to higher payables and accruals and provision for taxation. Payables and accruals increased to RM72.8 million as at 30 June 2024 from RM71.5 million as at 31 December 2023 whereas provision for taxation increased from RM11.9 million as at 31 December 2023 to RM26.0 million as at 30 June 2024.

Non-current liabilities increased to RM59.4 million as at 30 June 2024 from RM59.0 million mainly due to higher deferred tax liabilities.

Commentary On Current Year Prospects

In the current year, the supply of gloves has normalised. However, the business is facing challenges of price competition, currency fluctuations, volatile raw material prices, and increased production costs.